Method of calculating relief to be allowed for double. The title or contents topics covered under sections 1 to 298 of Income Tax Act 1961 as amended by the latest Finance Act 2022.

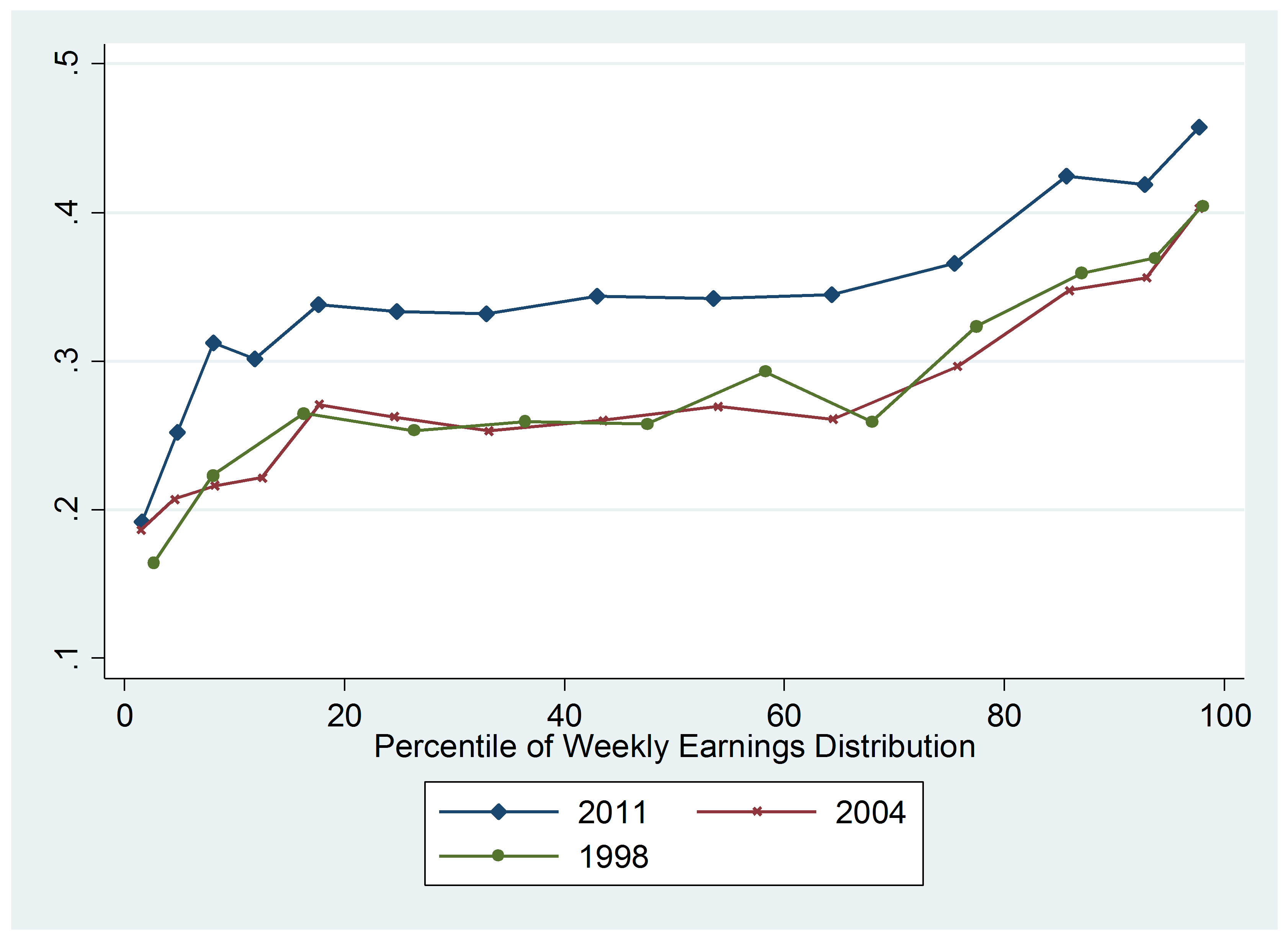

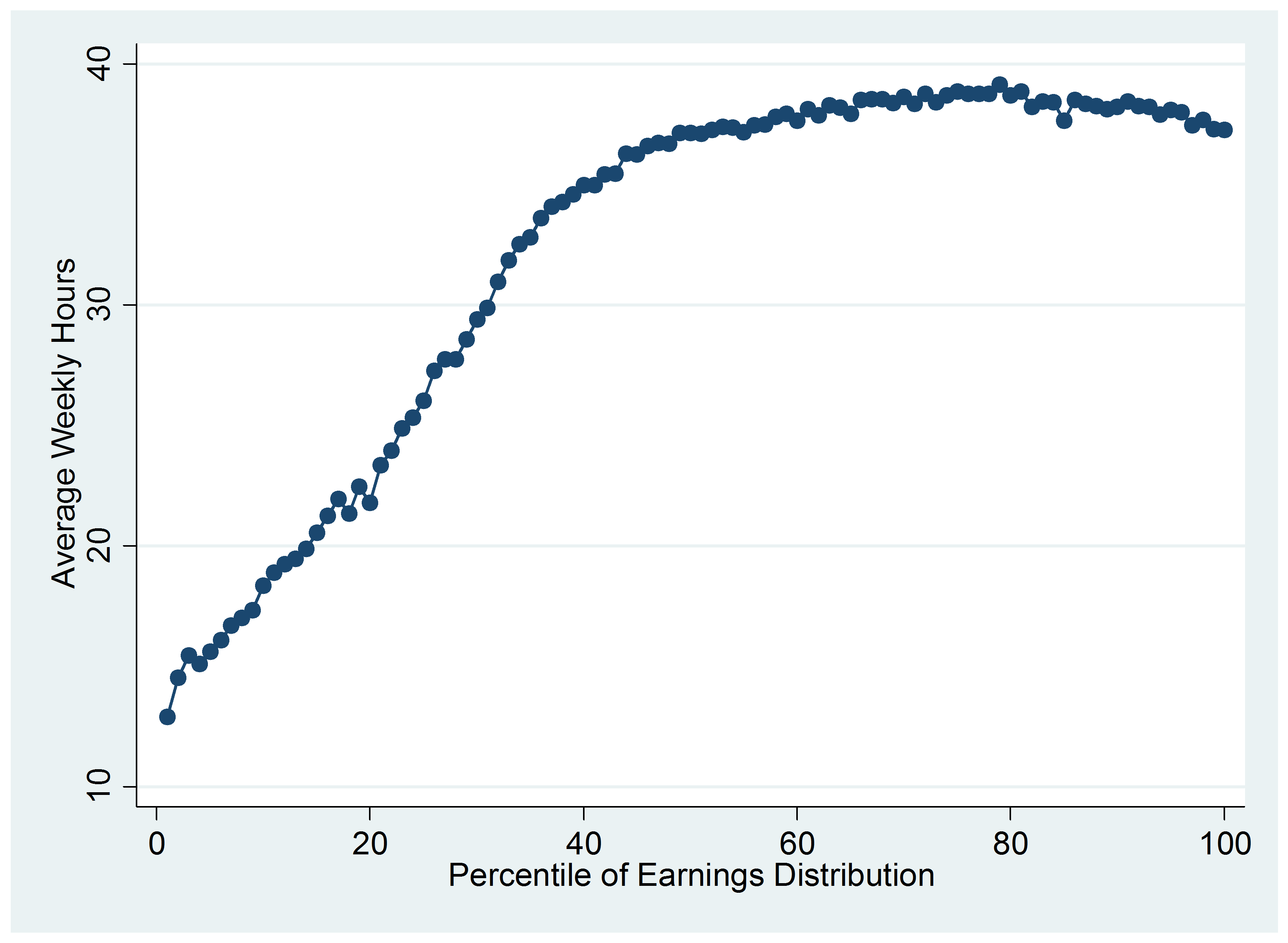

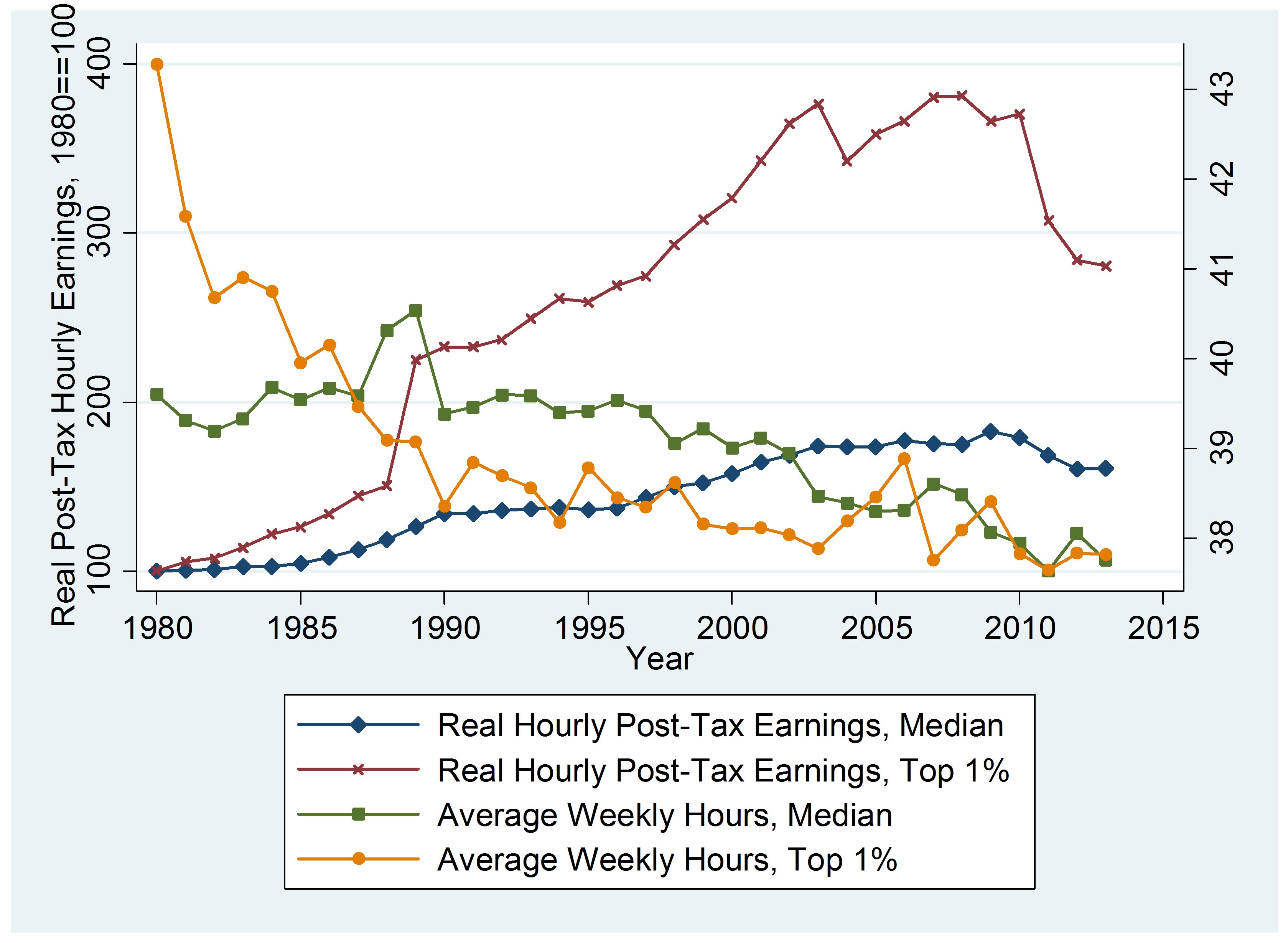

The Top Rate Of Income Tax British Politics And Policy At Lse

Exemption under Section 10 33 on income earned on transfer of an asset of Unit SchemeIf an income is earned when a capital asset which is a unit of the Unit Scheme 1964 as specified in Schedule I to the Unit Trust of India Transfer of Undertaking and Repeal Act 2002 the income would be exempted provided that the income is earned on or after 1st April 2002.

. The Parliamentary Counsel Office has made editorial and format changes to this version using the powers under subpart 2 of Part 3 of the Legislation Act 2019. 1 - Short Title 2 - PART I - Income Tax 2 - DIVISION A - Liability for Tax 3 - DIVISION B - Computation of Income 3 - Basic Rules 5 - SUBDIVISION A - Income or Loss from an Office or Employment 5 - Basic Rules 6 - Inclusions 8 - Deductions 9 - SUBDIVISION B - Income or Loss from a Business or Property 9 - Basic Rules 12 - Inclusions 18 - Deductions 22 - Ceasing. Chapter-wise list of all sections under Income-tax Act 1961 as amended by the Finance.

Kāinga OraHomes and Communities Act 2019 2019 No 50. 4 Income tax refunds or credits. For extension of Act to Continental Shelf of India see Notification No.

4 manner has the meaning given by section 43-145. Income Tax Amendment. In relation to section 31 a controlled transaction will be any transaction between connected persons as defined in section 1 of the Act.

An assessee who is required to file a return of income is entitled to revise the return of income under Section 1395 of Income Tax Act 1961 originally filed by him to make such amendments additions or changes as may be found necessary by himSuch a revised return may be filed by the assessee at any time before the end of the relevant assessment year or before. Deduction of tax from certain income. Public Act 2007 No 97.

70 DFE rule has the meaning given by section 394- 35. GSR 304E dated 31-3-1983. 100 subsidiary has the meaning given by section 975- 505.

Subdivision A Assessable income generally. For details see Taxmanns Master Guide to Income-tax Act. List of All Sections of Income Tax Act.

Income Tax Act 1959. Penalty for failure to make deductions under section. Total income from all sources.

PART IV Ascertainment of total income 36. For effective date for the applicability of the Act in the State of Sikkim see Notification. The amount included in federal adjusted gross income for federal income tax purposes for the taxable year that is not included in federal adjusted gross income under the West Virginia Personal Income Tax for the taxable year.

Sections 43 to 80. Income Tax Act 1959 No. INCOME TAX ASSESSMENT ACT 1997 - SECT 9951 Definitions 1 In this Act except so far as the contrary intention appears.

Act 13 of 1985 OG 5115 deemed to have come into force from the beginning of the financial year of a company ending on or after 1 July 1985 section 2 of Act 13 of 1985 Income Tax Amendment Act 11 of 1986 OG 5234 deemed to have come into force on 1 March 1986 section 2 of Act 11 of 1986. 95 services indirect value shift has the meaning given by section 727-700. Personal relief and relief for children dependants.

Taxation Annual Rates for 201920 GST Offshore Supplier Registration and Remedial Matters Act 2019 2019 No 33. Deductions to be claimed. A In anticipation of or during an emergency defined in subsection d the board of directors of a corporation may.

Income Tax New Zealand Green Investment Finance Limited Order 2019 LI 2019119. BDeduction of Tax 35. And 2 relocate the principal office.

PART V Rate of tax and double taxation 37. To make sure that taxpayer does not default in paying taxes or disclosing the information there are several penalties. A timely and consistent paying of taxes and filing of returns ensures the government has money for public welfare at any point of time.

Subdivision B Trading Stock. Note 4 at the end of this version provides a list of the amendments included in it. Deduction of tax from annuities etc paid under a will etc.

Jan 13 2022 - 115333 AM. INSPITE of all the contributions made to social causes there is a huge gap between the demand of money from the needy and the amount donated by philanthropistsThis probably is the reason why the Government has given tax benefits on donations. A transaction which is concluded at arm s length between enterprises that are not connected persons in relation to each other.

INDEPENDENT STATE OF PAPUA NEW GUINEA. Ascertainment of chargeable income. 1 modify lines of succession to accommodate the incapacity of any director officer employee or agent.

Charge of income tax. Commencement see section A 2. Income Tax Act 2007.

Subdivision C Business Carried on Partly in and Partly out of Papua New Guinea. Summary of Penalties Under the Income Tax Act Updated on. For applicability of the Act to State of Sikkim see section 26 of the Finance Act 1989.

The amount donated towards charity attracts deduction under section 80G of the Income Tax Act 1961. For understanding the overall concept of Income Tax Law in India one should have to know all sections of income tax ie. Deductions of tax from emoluments.

Income Tax Act 1959. PART VI RATES DEDUCTIONS AND SET-OFF OF TAX AND DOUBLE TAXATION RELIEF ARates of Tax 34. Date of assent 1 November 2007.

Trusts Act 2019 2019 No 38. 1 - Short Title 2 - PART I - Income Tax 2 - DIVISION A - Liability for Tax 3 - DIVISION B - Computation of Income 3 - Basic Rules 5 - SUBDIVISION A - Income or Loss from an Office or Employment 5 - Basic Rules 6 - Inclusions 8 - Deductions 9 - SUBDIVISION B - Income or Loss from a Business or Property 9 - Basic Rules 12 - Inclusions 18 - Deductions 22 - Ceasing. Is able to influence the transfer price set.

The Top Rate Of Income Tax British Politics And Policy At Lse

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

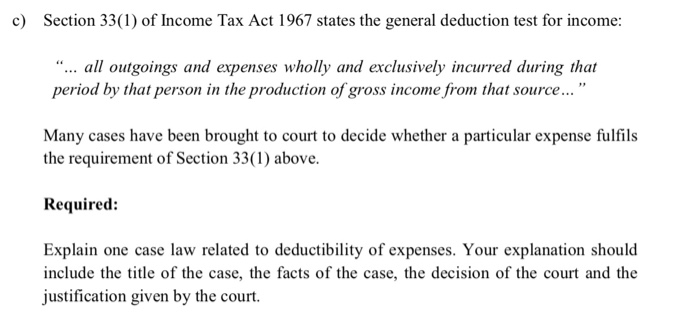

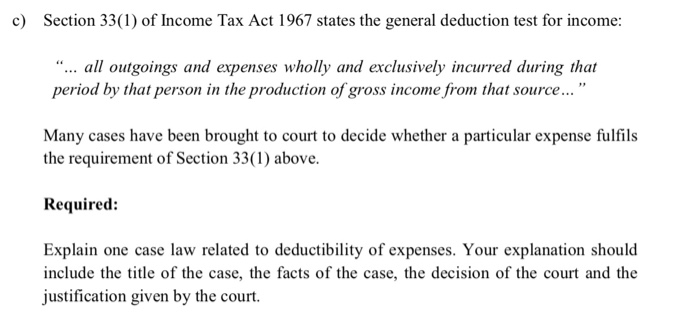

Solved C Section 33 1 Of Income Tax Act 1967 States The Chegg Com

Tax Flowchart Double Taxation Capital Gains Tax Capital Gain Risky Business

Blogger S Beat The Business Side Of Blogging Blogging Advice Coding Activities

Additional Evidence Before Commissioner Of Income Tax Appeals Income Tax Income Tax

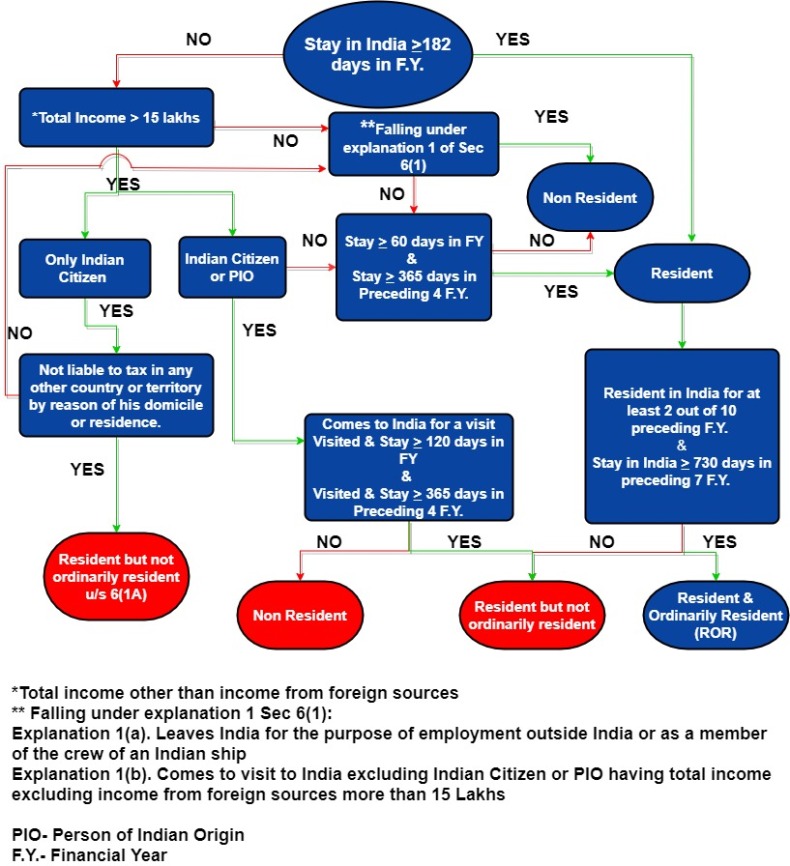

Residential Status Under The Income Tax Act Ca Rajput

Is Corporation Tax Good Or Bad For Growth World Economic Forum

The Top Rate Of Income Tax British Politics And Policy At Lse

Form 33 Clearance Certificate Online Taxes Filing Taxes Tax Services

Save Tax Up To Rs 45 000 Invest In Mutual Fund Elss Advantages Of Mutualfund Elss Schemes Over Other Tax Saving In Finance Saving Investing Mutuals Funds

Income Tax Refund When There Is A Mismatch Between Actual Payable Tax And The Tax Amount Paid Then The Itr Refund Pro Tax Refund Income Tax Income Tax Return

061616 Eitc Infographic Infographic Boost Income Criminal Justice

Income Tax Department Wikipedia

Ntn Tax Filer Pra Gst Chamber Tm Logo Reg Income Sales Tax Return E Filling Audit Notice Handling Tm Logo Tax Advisor Logo

Pin By Vipin Kumar On Vipin Kumar Coding Enhancement Qr Code